COMMON SENSE ENERGY COST MANAGEMENT

Founded in 2010, Tritium Energy Consulting, LLC helps businesses to navigate the complexities and nuances of buying and managing retail power & gas. Equipped with nearly 2 decades of industry experience, our President, Alex Oberman, is a retail power & gas markets veteran, seasoned energy commodities analysts, and avid day trader.

The Tritium Value

-

In order to secure the most competitive prices in a competitive market, it's essential to identify the top energy providers. Our experience in deregulated power and gas markets since 2006 has allowed us to forge relationships with the strongest and most competitive suppliers in each market- guaranteeing we find you the best price at any given time.

Tritium will facilitate competitive bids from over 10 energy providers for your electricity and natural gas requirements, ensuring that quotes are apples-to-apples, negotiate favorable terms, and discover the best price in the market ensuring you are in fact making an informed decision on who is the best energy supplier for your company.

To know if a price is as it’s presented means understanding the components to pricing electricity. Each states Public Utility Commission regulates whether various components can be “Passed thru” or “Non-Pass thruable”, meaning whether the Retail Electric Provider elects to include said component in their quotes. If you don’t know the components involved in your bids from suppliers then there’s a good chance what you see is not what you will get.

Tritium Energy deliverables:

Identify the best suppliers and capture the best price.

Confirm quotes are comparable Apple-to-Apples quotes.

Negotiate all components are “Fully Fixed” prices with nothing variable.

-

Tritium Energy uses two distinct but equally important approaches when analyzing and trending price action in energy markets; Technical & Fundamental Analysis. Together both schools of analytics can help one determine a “Market View”.

Fundamental Analysis + Technical Analysis = Market View

Technical Analysis in energy markets is a type of analysis that uses price and volume data to evaluate the current and future value of a commodity. This type of analysis looks for patterns in the price and volume data to identify trends and make predictions about future market movements. Technical analysis is often used to assess the current market sentiment and make decisions on when to buy, sell, or hold a certain commodity.

Fundamental Analysis in energy markets is a type of analysis that uses macroeconomic and industry-specific data to evaluate the current and future value of a commodity. This type of analysis is used to assess the financial health of the energy sector, as well as the current and future demand for a certain commodity. This type of analysis also helps investors make decisions on when to buy, sell, or hold a certain commodity.

Perfectly timing the bottom and avoiding price spikes is nearly impossible, aside from sheer luck. Tritium will proactively manage your current contract for opportunities to renegotiate and/or put new contracts into place. You can expect regular updates from Tritium on prevailing energy prices versus your contracted rates each quarter so that you have peace of mind knowing exactly where your prices stand against the market. Staying proactive cannot be overstated to hedge costs when prices move in your favor.

Developing a Market View, and doing so regularly, is imperative to managing energy commodities cost. A Market View will determine contract execution timing, contract duration, and future contract negotiations.

-

Agent, Broker, Consultants (ABCs) like Tritium have agreements with Retail Electric Providers (REPs) allowing us to mark-up providers’ quotes with what are known as “MILS” or $0.001. Unlike other industries where commissions are regulated, retail energy market regulators have not chosen to mandate that consultants disclose their commissions. 9 out of 10 ABCs will tell their prospects/clients when asked how they make their money, “We are paid a commission equal to a direct sales rep by the supplier that wins your business, so you don’t have to worry about it.” It is uncertain what percentage of brokers that are not upfront about how commissions are calculated are honest, however at Tritium we feel it best to disclose our commissions. We are open to negotiate the cost of our service for every client.

Understanding the task.

Energy cost management can be simplified down to 3 questions:

When to sign your contract?

What energy supplier to sign with?

How long should your contract be?

-

Due to the unpredictable nature of energy markets, determining the right moment to sign energy contracts is crucial, albeit challenging. It's essential to consider factors such as crucial support and resistance price levels, market drivers, the most favorable time of year to sign, and overall market sentiment. Continuously monitoring the markets allows you to seize opportunities when they arise, ensuring the most advantageous timing for signing energy contracts.

-

With more than 40 retail providers in most deregulated natural gas and electricity markets, each boasting the lowest rates and superior customer service, managing energy suppliers can be a complex task. It involves activities such as gathering multiple bids on a single trading day for a fair comparison, negotiating service terms, resolving billing issues, and confirming the accuracy of the quoted price, all of which necessitate considerable time and industry knowledge to be carried out effectively.

-

Business owners have the best understanding of their company's capacity to handle upward price fluctuations. The process of determining contract duration involves weighing the trade-offs between risk and certainty, and taking into account both the prevailing market outlook and the unique needs of the business.

Energy Market Knowledge

Natural Gas & Electricity Correlation

As a primary energy resource and commodity, natural gas stands apart from electricity, which is a secondary energy resource generated using primary resources. The abundance of natural gas in the U.S. and its position as the cleanest primary energy source among hydrocarbons have contributed to ongoing expansion in both natural gas production and electricity generation fueled by natural gas. As a result, our primary consideration when examining and forecasting electricity trends is natural gas, which serves as the key determinant of domestic power prices.

Natural Gas Futures Markets

In addition to evaluating historical natural gas price settlements against current prices, Tritium closely monitors the futures market to assess the trajectory of energy costs. Displayed here is the natural gas futures price curve through 2028, with price increases during winter months due to heightened heating demand. These monthly price settlements serve as the basis for Retail Natural Gas/Electricity Providers to determine fixed-price energy contracts, making them the most reliable indicator of future price trends.

Fundamental Analysis

Important factors to considering when developing a Market View using fundamental analysis.

Demand:

Weather

Economic Growth

Generation compliment; coal, nuclear, hydro, alternatives

Exports

Supply:

Weather phenomena; hurricanes, winter/summer intensity

Congestion

Production

Imports

Price of alternative primary energy sources

On peak/Off peak

Underground working storage

Technical Analysis

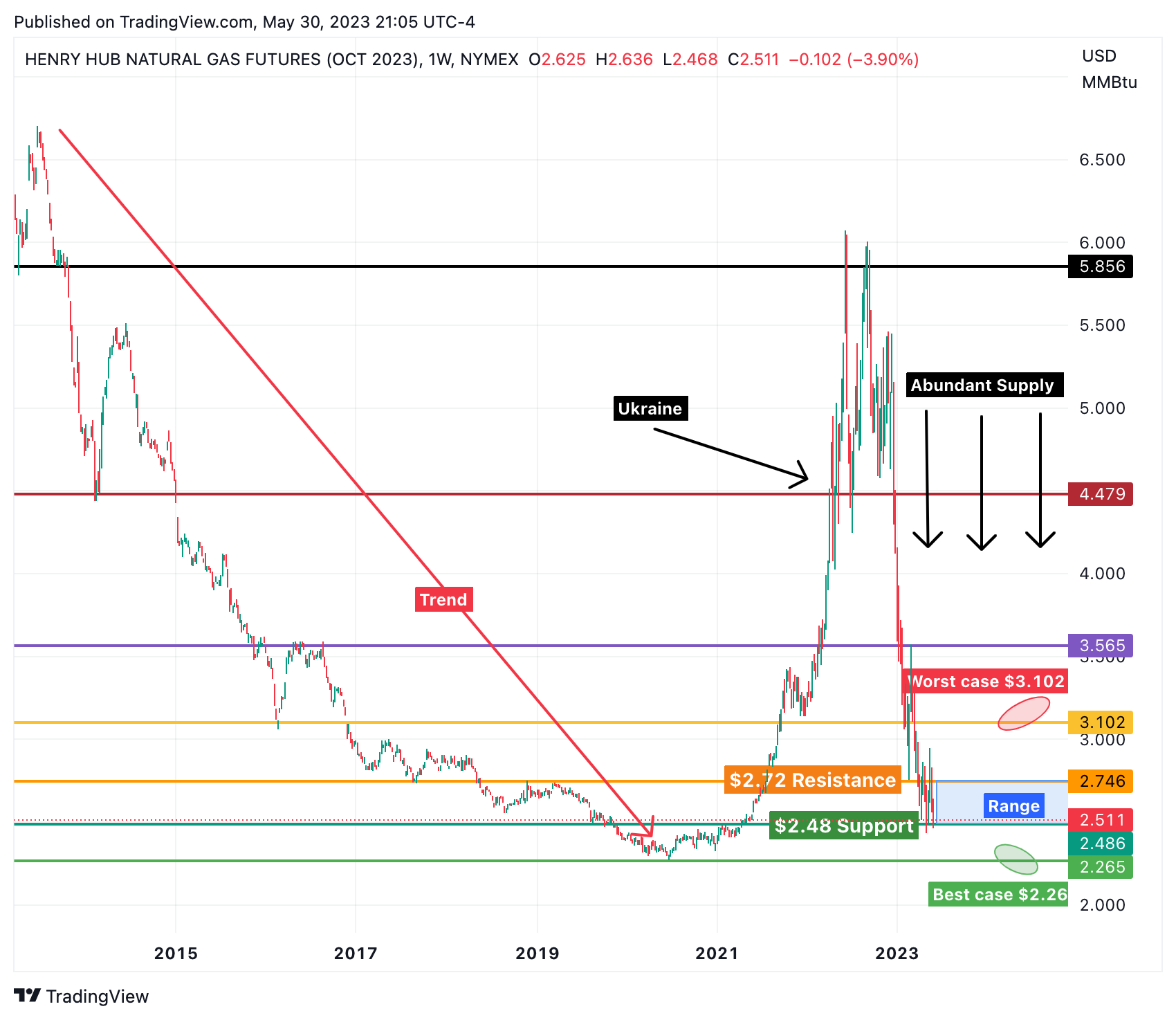

Here you can see the important price levels of natural gas which enable us to track and chart changing Support & Resistance levels. Each of these levels act as a crucial indicator to price action and identifying trends that help us to advise on when to sign and how long to sign energy futures contracts for. The 10 year bear market brought forth by shale and horizontal drilling technologies was reversed with executive policies from a change in Presidential administration and further bolstered by Russia’s invasion of Ukraine. We will share these charts with you regularly with relevant key levels and watch together as price action develops.

Hedging: Risk vs. Certainty

Effectively managing energy expenses requires a solid grasp of the inverse correlation between risk and certainty. Retail power and gas suppliers typically present fixed-price contracts that span up to 60 months, creating a 5-year risk/certainty window. A 30-month contract serves as the mathematical halfway point, offering a balanced hedge against risk and certainty. When evaluating the level of risk your business should assume, it's critical to take into account the prevailing trend and the duration left on your current agreement. Tritium guides clients in accurately identifying their risk levels and the potential positive and negative implications.